A Tax law firm for resident and non-resident of France companies

Rely Avocat accompanies French resident and non-resident companies in all their income tax issues (Corporate tax or income tax), of VAT, of local taxes, of payroll tax, of energy and environmental taxes and all other taxes of which lawmakers may think of.

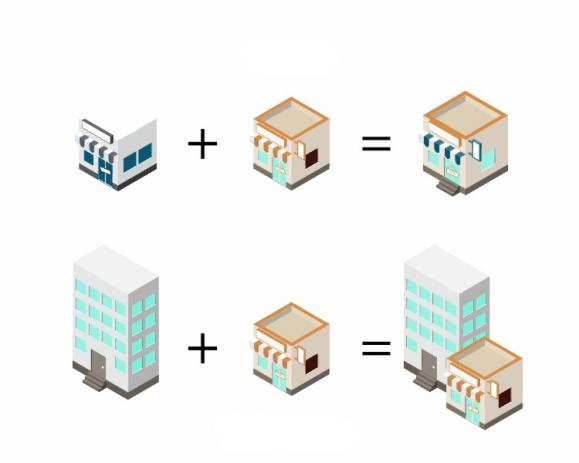

Establishment in France or abroad

Thanks to Rosemary Billard-Moalic’ s experience in international taxation , Rely Avocat secures the tax treatment of French companies which establish abroad and foreign companies which establish in France. Rely Avocat notably helps international groups to determine if they have a permanent establishment in the country hosting their activity.

Day-to-day business operations

Rely Avocat supports its corporate clients in their day-to-day operations, particularly during the audit of their taxable income.

Rely Avocat also helps companies to secure the taxation applied to flows between related companies (for example, dividends between a subsidiary and its parent company, interests where a company grants a loan to a related company, royalties where a company pays another in return for the use of intellectual property).

Rely Avocat can also provide support to a company which has to sort out energy and environmental taxes.

-

By telephone :

-

By email :

-

We remind you :

Outstanding corporate operations

Rely Avocat advises its corporate clients in carrying out outstanding operations such as restructurings: takeover of a company by another, merger of several companies or contribution of activity or assets from one company to another.

Rely Avocat can also set up a tax consolidated group where the activity is carried out by several companies, whether located in France or abroad.

Discussion with the tax authorities and litigation

Rely Avocat accompanies its corporate clients in all stages of their relationship with the tax authorities , whether in the context of the new relationship of trust that allows the authorities to stand by companies or during a tax audit and any resulting tax adjustment. Rely Avocat can also secure the tax treatment of a particular issue by asking the tax authorities to give a ruling.

Rely Avocat also assists its corporate clients in court where they wish to challenge a decision by the tax authorities, and so up until the end of litigation where tax is relieved or recovered.

Also see: